Global remanufacturing benchmark – part six

Although the world looks different in 2020, Rematec and Kemény Boehme & Company (KBC) regard remanufacturing to be an important instrument of after-sales. In the second edition of the exclusive Global Remanufacturing Benchmark (GRB), both organisations have gained insights into remanufacturing trends, developments and challenges. The survey was conducted before and during Rematec Amsterdam (June 2019) and Rematec Asia in Guangzhou, China (October 2019), which allows us to take a closer look at the situation in the European and Asian markets before Covid-19 shook the world. We’ll have a series of articles about industry players and challenges, markets, products and processes, core management, quality and marketing & sales. Today part 6: Marketing & sales.

Marketing & sales

Major sales channels for remanufactured parts are direct sales (43%), distributors (40%) and / or E-commerce (17%). While most of the remanufacturing professionals state that target customers are primarily the own organisation’s customers (65%) other remanufacturers also target competitors’ customers (35%).

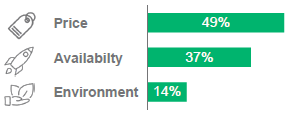

The motivation for the survey participants’ customers to buy remanufactured parts is predominantly the price saving. Other customers chose remanufactured parts due to spare part availability.

Environmental reasons are also a decisive factor for the purchase decision, which will continue to gain in importance due to the increasing focus on environmental and climate protection and sustainability. (See figure 1).

Fig. 1: USP of remanufactured parts

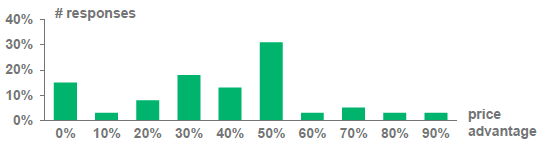

The financial advantage of remanufactured parts in relation to new ones is most commonly between 30% and 50%. (See figure 2).

Fig. 2: Price advantage of remanufactured parts

Remanufacturers expect future sales potential predominantly to grow significantly: while more than one third expect sales to increase more than 10%, half of the remanufacturers expect a growth of 5% to 10%.

Related content

Global remanufacturing benchmark part one: Industry and Challenges

Global remanufacturing benchmark part two: Market

Global remanufacturing benchmark part three: Products & Processes

Global remanufacturing benchmark part four: Core management

Global remanufacturing benchmark part five: Quality

More information on the global remanufacturing benchmark

Share your remanufacturing stories with us

Do you have an innovation, research results or an other interesting topic you would like to share with the remanufacturing industry? The Rematec website and social media channels are a great platform to showcase your stories!

Please contact our Brand Marketing Manager.

Are you an Rematec exhibitor?

Make sure you add your latest press releases to your Company Profile in the Exhibitor Portal for free exposure.