China on the Rise

At the World Remanufacturing Summit in Bejing in May this year, delegates heard that China’s business environment is not the most conducive to core collection and reverse logistics and that there is a general lack of acceptance of reman products from domestic consumers. It is fair to say that these issues remain in China as 2016 draws to a close. But what potential there is in this vast country: total output value of the remanufacturing sector in China was estimated to be ¥150 billion (€17.6 billion) in 2015 – but Shi Peijing, vice director of the country’s National Key Laboratory for Remanufacturing, believes this could quadruple by 2020. By comparison, the European Remanufacturing Network estimates the current size of the European reman industry to be just under €30 billion, with predicted growth to €90 billion by 2030. ReMaTecNews was invited to attend the official opening of the South China Remanufacturing Base, situated within the Wuzhou Industrial Park for Processing Imported Recyclables, which lies a few hours’ drive from the southern metropolis of Guangzhou - China’s third city after Beijing and Shanghai. The unveiling ceremony was a chance to take stock of where reman in China is at present – and where leading figures in the country’s industry think it will go in the future. While a relatively young sector – its genesis in China can be traced back to the 1990s - it now only trails the US and European Union as a remanufacturing powerhouse. Spotting an opportunity to create good quality jobs, the Chinese government is fully behind reman and is helping with various incentives and subsidies, including relaxing trading rules for companies which operate from one of four remanufacturing industrial demonstration parks – Wuzhou is the latest - which it has so far approved. These newly-constructed parks are aimed at foreign investors as well as domestic ones, and complement the government’s existing Free-Trade Zones (FTZs) in China. While far from an economic free-for-all, they represent a more relaxed approach to doing business with the rest of the world – something that observers feel will be essential for expansion.

Environmental credentials

As leading reman researcher Liang Xiubing pointed out at the Sino-European Remanufacturing Forum which followed the Wuzhou facility opening, 70% of environmental pollution comes from manufacturing and therefore reman (which saves 60% of energy and 70% of raw materials) is part of what the Chinese call “building an ecological civilisation”. For a country which is keen to establish its environmental credentials, this is important – not to mention the fact that reman creates employment in a country with a large labour market, and helps to secure resources. The Japanese feel that reman in China is “a sunrise industry which has a long way to go”, says Otomo Kazuyoshi of Tokyo-based auto parts reman group Broadleaf Co. But it is advancing fast: China is a rapidly-growing consumer economy. Individual car ownership in the country climbed above that of Japan as recently as 2010, for example, but was more than double by 2015. This would seem to bode well for future reman. In 2009 the government passed the Circular Economy Promotion law, which emphasised the importance of reman. The national strategy China Manufacturing 2025 contains reman elements, and 2015’s ‘old for reman’ pilot scheme - in which companies received a discount for using reman parts as replacements – is a demonstration of intent. The Chinese Academy of Engineering says it is involved with successful reman projects in aviation and oil/petrol as well as the automotive industry. Regulation comes from two Chinese government ministries: the National Development and Reform Commission (NDRC) and the Ministry of Industry and Information Technology (MIIT). Two programmes - Remanufacturing Pilot Enterprises (RPEs) and MIIT Remanufactured Product List (RPL) – have been launched, with RPEs having to demonstrate that they have the necessary capacity and competence to be given official approval, and the RPL scheme aimed at ensuring that the finish of remanufactured products is of a sufficiently high quality.

Foreign involvement

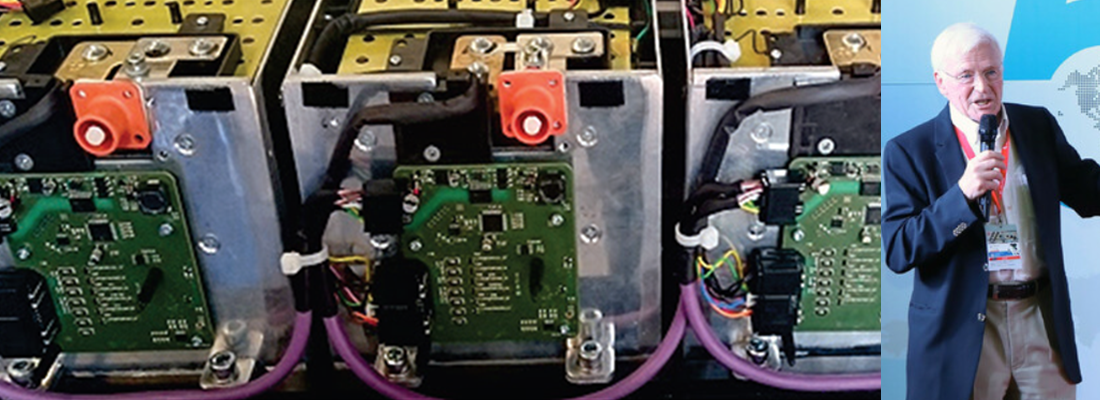

Some foreign companies are well ahead of the curve when it comes to seeing what China has to offer in terms of reman. For example, Caterpillar Remanufacturing Services (Shanghai) Co was established as long ago as December 2005 and remanufactures engine components such as oil pumps, water pumps, cylinder heads and cylinder packs and fuel injectors. As well as Caterpillar, Daimler-Benz has taken up space at facilities, while ZF Aftermarket’s local organisation ZF Services (China) Co has gained a remanufacturing licence from NDRC to establish its reman centre in Shanghai, working on automatic passenger car transmissions and mechatronics. The idea is that it will also have the capacity to remanufacture non-ZF components. Representatives from automotive manufacturers were invited to the table from the beginning in order to help shape the processes and the transfer of individual know-how successfully: the company says this close collaboration was the key to securing its supply of cores as well as remanufactured transmissions. Initial efforts have focused on the 6, 8 and 9HP transmissions installed in BMW, Jaguar, Land Rover and Audi models in China. Such activity – both from within and outside China - suggests that there is no shortage of interest in reman here, and that this is going to be a sector which will only attract more attention in future. Indeed, delegates at the Wuzhou reman forum suggested that the only thing holding back Chinese reman was red tape. “It’s restricted by laws, rules and regulations,” commented one company executive. “If that can be solved then there’s no limit.” So it is true that this ‘sunrise industry’ of China may well have a long way to go – but it is definitely starting to hot up.

From laboratory to factory floor

“The government is positive and encouraging,” says Shi Peijing, vice director of the National Key Laboratory for Remanufacturing. But he would like to see more done: for example, there is at present no requirement for government departments to purchase reman parts, although there are plans for this. Also, despite a relaxation of trading conditions in some areas, import/export restrictions on cores are hampering the industry somewhat.

Core problem

The main problem is that cores are often seen as waste products rather than engineering opportunities. “If we can break the barriers to cores it could be good for the industry,” says Shi. Founded in 2003, the laboratory is a hotbed of academic discovery: it has around 50 full-time researchers and over 100 PhD and MPhil students working across all areas of reman. It carries out vital R&D on reman technology, acting as a link between research bench and factory floor, working with the government on setting policy, determining inspection standards and so on. The lab has been granted 40 Chinese and international patents, and published around 900 papers, along with 18 national standards in reman. More are under development, and a labelling scheme for remanufactured automotive parts has been established. The laboratory’s remanufacturing facilities include surface analysis instruments, rapid forming systems and surface coatings preparation facilities. The main problem for reman in China is to convince consumers that its products are worth buying, Shi believes. “On the consumer side, we are still too far from learning about the benefits of reman,” he says.

A long way to go

“The heavy duty truck and engineering industries see reman is important – and if you can persuade those big companies then you have a large part of the market. But when it comes to small auto parts to end users, there is still a long way to go for consumer acceptance.” On the subject of the cheap parts which are manufactured in China – and therefore squeeze the market for reman parts – he is calm. “Different sectors are in different situations,” he says quietly. “Because of over-production, some big OE companies are reluctant to get into reman.” While this is another potential barrier, he is confident that reman can overcome it – and he also sees interesting areas of expansion. “Now, China is mostly about reman of auto, where there is maybe less profit,” he says. “But there is the potential for marine engines. Reman has a lot of opportunity there. And also the chemical industry, although China hasn’t started that yet.”

Barriers to reman in China

Apart from sluggish consumer acceptance of reman as a concept in China, there a few policy barriers which may be putting a brake on the industry. In his report, Remanufacturing Mission to China, Yan Wang of the University of Brighton identified the following this year:

- End-of-life automotive components such as engines, steering parts, gearboxes and front and rear axles must be treated as waste and sent for recycling rather than being remanufactured

- Remanufactured auto components are not allowed to be used to service in-warranty vehicles, thus the market for remanufactured auto components is limited to the after-sale market. This has restricted the availability of cores although it is expected this law will be changed in the near future

- China currently prohibits the import and export of core and remanufactured products, which has undermined the development of the remanufacturing sector

- Another issue has been the over-production of similar components which are sold at very low prices

In FTZs, imported cores can be remanufactured on condition that they must be exported and not sold in the Chinese domestic market.

Share your remanufacturing stories with us

Do you have an innovation, research results or an other interesting topic you would like to share with the remanufacturing industry? The Rematec website and social media channels are a great platform to showcase your stories!

Please contact our Brand Marketing Manager.

Are you an Rematec exhibitor?

Make sure you add your latest press releases to your Company Profile in the Exhibitor Portal for free exposure.