Loading component...

Crashed electric cars: what happens to the batteries?

In an interview with Reuters, Matthew Avery, research director at Thatcham Research, expressed concern about crashed electric cars. According to Avery, in many cases, there is no way to repair or assess damaged battery packs, forcing insurance companies to scrap even low-mileage vehicles, resulting in a significant increase in insurance premiums. This critical issue also affects remanufacturing, and it specifically conflicts with measures aimed at continuously improving sustainability and circular economy in the automotive industry.

We're buying electric cars for sustainability reasons, but an EV isn't very sustainable if you've got to throw the battery away after a minor collision.

Furthermore, battery packs can cost tens of thousands of dollars and account for up to half of an EV's total cost, making replacement often uneconomical. Avery emphasises that this is a major issue not only for consumers, but also because discarded batteries in many countries are not recycled in a timely manner, posing a serious risk of pollution and warehouse fires. In addition, while some automakers, such as Ford Motor Co and General Motors Co, claim to have made battery packs easier to repair, Tesla has taken the opposite approach with its Texas-built Model Y, whose new structural battery pack has been described by experts as having "zero repairability." Tesla's decision to make battery packs "structural" - part of the car's body - has allowed it to reduce production costs, but it risks passing those costs on to customers and insurers. Tesla hasn't mentioned any issues with insurers writing off its vehicles.

However, CEO Elon Musk stated that premiums charged by third-party insurance companies were "in some cases unreasonably high." Unless Tesla and other carmakers produce more easily repairable battery packs and provide third-party access to battery cell data, already-high insurance premiums will rise further as EV sales increase and more low-mileage cars are scrapped after collisions, according to insurers and industry experts. Christoph Lauterwasser, CEO of the Allianz Centre for Technology, predicts that the number of cases involving irreparable batteries will rise because most manufacturers restrict access to battery data, making it impossible to diagnose cell damage even in minor incidents. As a result, insurance companies can no longer guarantee functionality. EVs account for only a small percentage of vehicles on the road, making industry-wide data difficult to obtain; however, the trend of low-mileage zero-emission cars being written off with minor damage is growing. Most automakers claim their battery packs are repairable, but few appear willing to share battery data. In the EU, insurers, leasing companies, and car repair shops are already at odds with car manufacturers over access to lucrative connected-car data. Lauterwasser stated that access to EV battery data is part of the fight. Allianz has seen scratched battery packs with likely undamaged cells inside, but without diagnostic data, it must write off those vehicles. Ford and General Motors tout their newer, more repairable packs. However, the new, large 4680 cells in the Model Y, manufactured at Tesla's Austin, Texas, plant, are glued into a pack that is integrated into the car's structure and cannot be easily removed or replaced. Tesla CEO Elon Musk stated that the company is making design and software changes to its vehicles to reduce repair costs and insurance premiums. Tesla owners can also purchase lower-cost insurance from the company in a dozen states in the United States. Insurers and industry experts also point out that because EVs are outfitted with the most advanced safety features, they have had fewer accidents than traditional vehicles.

Circular economy at risk

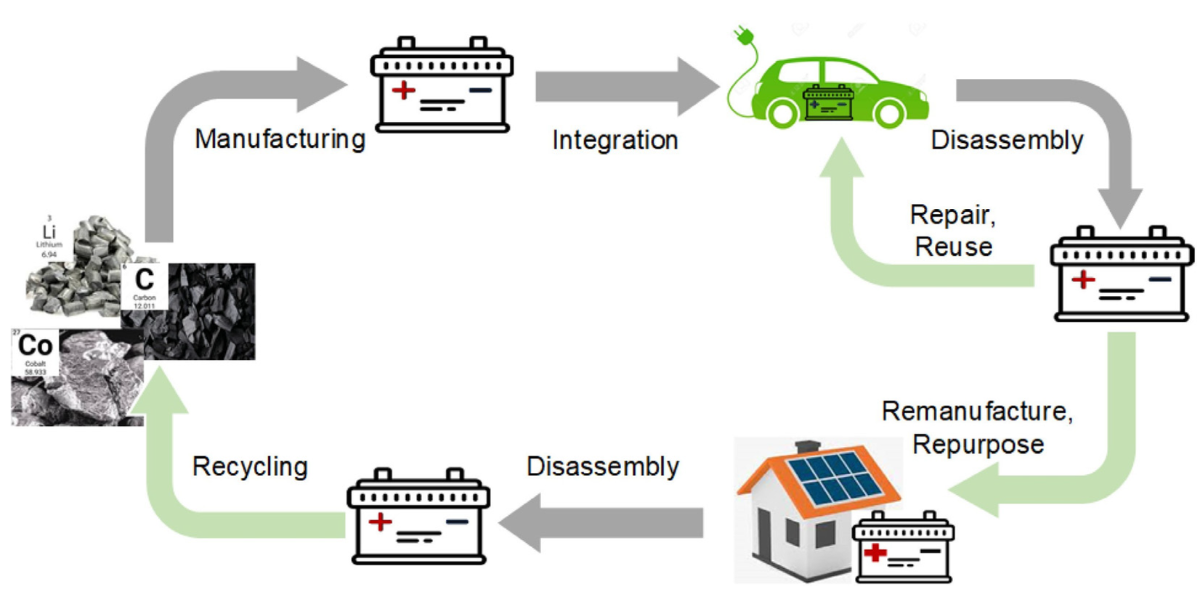

Lauterwasser also pointed out that EV battery making produces far more CO2 than fossil-fuel models, implying that EVs must be driven for thousands of miles to offset those additional emissions. "If you throw away the vehicle at an early stage, you've lost pretty much all advantage in terms of CO2 emissions," he said. Problems with EV batteries also highlight a flaw in carmakers' green "circular economy" claims. Head of operations Michael Hill at Synetiq, the UK's largest salvage company, said that over the last year, the number of EVs in the isolation bay - where they must be checked to avoid fire risk - at the firm's Doncaster yard has increased from perhaps a dozen every three days to up to 20 per day. "We've seen a really big shift and it's across all manufacturers," Hill said. Because there are no EV battery recycling facilities in the UK, Synetiq is forced to remove batteries from abandoned vehicles and store them in containers. Hill estimated that at least 95% of the cells in Synetiq's hundreds of EV and hybrid battery packs at Doncaster are undamaged and should be reused. Most electric vehicles are already more expensive to insure than traditional vehicles. According to online brokerage Policygenius, the average monthly EV insurance payment in the United States in 2023 will be $206, which is 27% higher than for a combustion-engine model. According to Bankrate, an online publisher of financial content, US insurers understand that "if even a minor accident results in damage to the battery pack ... the cost to replace this key component may exceed $15,000." A replacement battery for a Tesla Model 3 can cost up to $20,000, for a vehicle that starts at $43,000 but depreciates quickly over time. Andy Keane, UK commercial motor product manager at French insurer AXA, said that expensive replacement batteries "may sometimes make replacing a battery unfeasible."

There are a growing number of repair shops specializing in repairing EVs and replacing batteries. In Phoenix, Arizona, Gruber Motor Co has mostly focused on replacing batteries in older Tesla models. But insurers cannot access Tesla's battery data, so they have taken a cautious approach. An insurance company is not going to take that risk because they're facing a lawsuit later on if something happens with that vehicle and they did not total it," owner Peter Gruber said.

The newly adopted EU battery regulations do not specifically address battery repairs, but they did ask the European Commission to encourage standards to "facilitate maintenance, repair and repurposing," a commission source said. Insurers said they know how to solve the problem: divide batteries into smaller sections, or modules, that are easier to repair, and make diagnostics data available to third parties to determine battery cell health. Individual US insurers declined to comment. However, Tony Cotto, Director of Auto and Underwriting Policy at the National Association of Mutual Insurance Companies, said "consumer access to vehicle-generated data will further enhance driver safety and policyholders' satisfaction ... by facilitating the entire repair process." In 2023, a class action lawsuit filed against Tesla in U.S. District Court in California raised concerns about a lack of access to critical diagnostic data. Insurers warned that failing to act would cost consumers money. Lauterwasser said that while EV battery damage accounts for only a small percentage of Allianz's motor insurance claims, it accounts for 8% of claim costs in Germany. Germany's insurers pool vehicle claims data and adjust premium rates annually. "If the cost for a certain model gets higher it will raise premium levels because the rating goes up," Lauterwasser said.

Share your remanufacturing stories with us

Do you have an innovation, research results or an other interesting topic you would like to share with the remanufacturing industry? The Rematec website and social media channels are a great platform to showcase your stories!

Please contact our Brand Marketing Manager.

Are you an Rematec exhibitor?

Make sure you add your latest press releases to your Company Profile in the Exhibitor Portal for free exposure.